Posted By Cary Toor

Most businesses want – and need – one or more Sales People. This discussion takes a simple look at the math behind direct sales people for a subscription or recurring revenue model business.

First, let’s get the definitions out of the way first. A Sales Person is an individual who is contacting other individuals and/or businesses directly through email or phone to actually sell (including finalizing the sales) of a product or service.

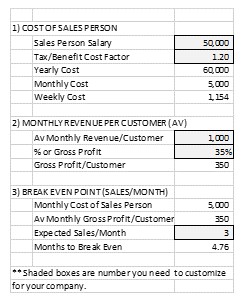

Let’s take a hypothetical Sales Person. Assume that the Sales Person costs $50,000 per year. If the Sales Person is an employee (as opposed to a contractor), the salary needs to be multiplied by a factor of 1.2 to get the actual cost – which includes taxes, 401K, insurance, and other benefits – which gets you to $60,000 per year. Under this analysis, our hypothetical Sales Person would cost $5,000 per month or $1,155 per week.

Assume an average price for your Company’s services of $1,000 per month per customer every month (reoccurring) to make the math easy. If you have a gross profit – profit after all direct costs of the service are deducted, but not including overhead costs such as rent or administrative salaries – of 35%, the profitability of the service is $350/month.

If you are going to roughly break even on our hypothetical $50,000 per year Sales Person, he or she must sell roughly 15 customers per month. That would generate $5,250 in sales. However, since you are generating reoccurring revenue every month, your sales person does not need to break even in a month. In fact, it doesn’t even make sense to have your Sales Person break even in a month.

So, one of your most important decisions you will need to make is how fast you want your Sales Person to break even. You need to be realistic. How many sales can you reasonably expect your Sales Person to make each month? Most companies I have worked with use a benchmark of 4-6 months. That would mean your hypothetical Sales Person would need to generate 4 sales per month or $1,400 in gross profit if you use a 4-month breakeven or 3 sales per month or $1,050 in gross profit if you use a 6-month breakeven. The bigger the gross profit percentage, the longer you can use for breakeven.

If you can’t break even on you Sales Person in 6-9 months, you need to consider one of the following:

- You are paying your Sales Person too much.

- Your monthly fees to your Customers are too low.

- You need another way to sell besides a Sales Person/Direct Sales model.

Not all services or products can be sold direct by a Sales Person. Low price, high volume services or services which generate a very slim gross profit are better sold through digital marketing.

If you plan to use commission in addition to salary to compensate your Sales Person, you might set your quota at the breakeven point (or a little above the breakeven point) and pay commission on anything sold above the breakeven point. So, in our hypothetical model above, if your breakeven point is 4 months, the quota would be 4 sales per month and commission would then be paid on the additional sales (using the gross profit, not the sales price).

Of course, you still need to hire an effective sales person who can meet or exceed your expectations for the number of sales per month. Also, remember that the first month or two may not be productive since it takes time for a new Sales Person to find his or her footing. Over time, however, the number of sales for a productive Sales Person in a set period should increase, which is one of the marks of an effective Sales Person.

I realize that this is a fairly simplistic way to look at sales costs vs. revenue. However, it is a good benchmark to allow you to figure out whether or not you can afford to use direct sales resources and what you can afford to pay. I have attached a copy of my model if you want to modify it for your situation and use it.